Fractional LP Share Sale: .25% ownership of 1 Class A LP share in CCI-Energy Crossing I, LP

15021 Katy Freeway, Houston, TX 77094Sale Type

Traditional Listing

List Price

$25,000

- Property Type

- Office

- Year Built

- 2008

- Square Feet

- 240,164

Sale Type

Traditional Listing

List Price

$25,000

- Property Type

- Office

- Year Built

- 2008

- Square Feet

- 240,164

Overview

Facts

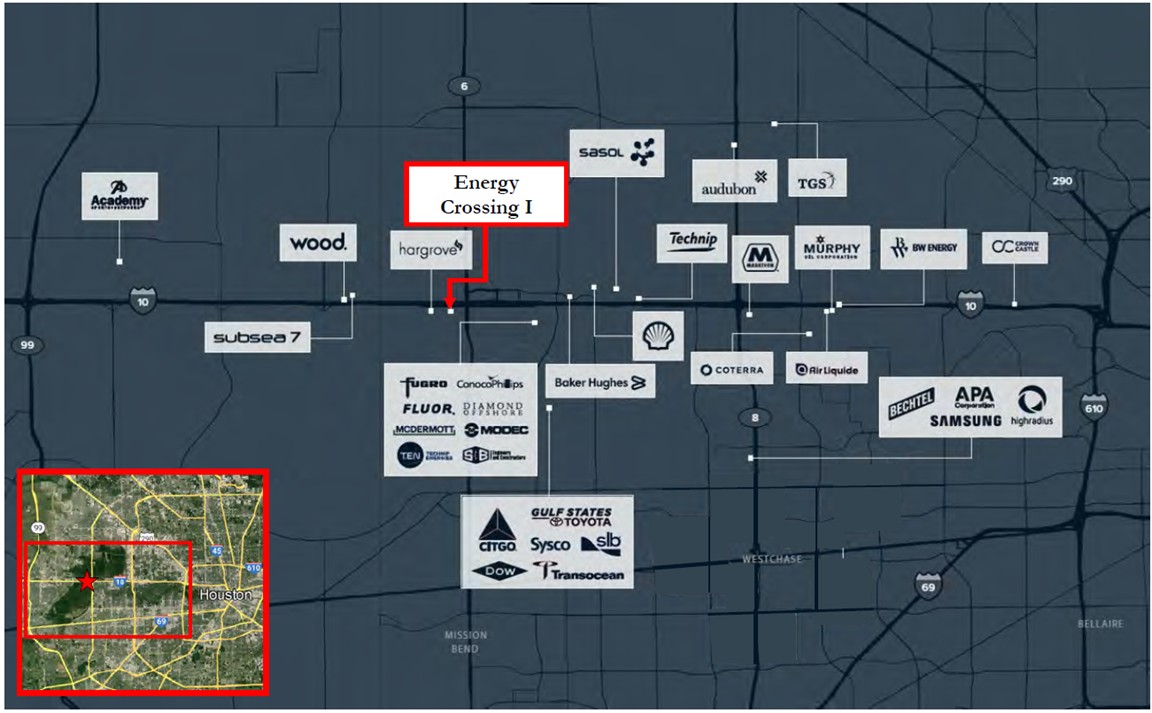

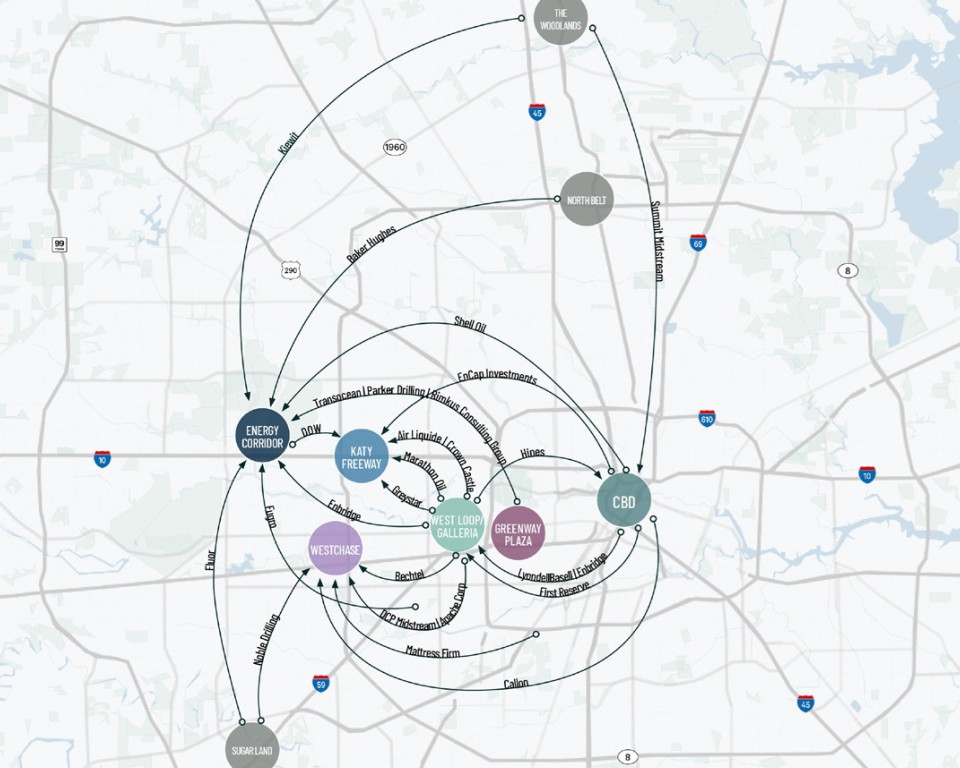

Capital Commercial Investments, Inc. "CCI" is selling ( 0.25% of 1 Class A LP share of CCI-Energy Crossing I, LP ('EC1')) a Texas limited partnership that purchased 15021 Katy Freeway in Houston, Texas for $17,250,000 ($72/SF) on August 7th, 2025. The purchase price is equivalent to 17% of the estimated replacement costs of $114.1 million ($475/SF) and 31% of the last sale price in June 2014 of $56.4 million or $325/SF. This partnership is capitalized at $30,000,000 with $7,500,000 of equity and a loan of $22,500,000. The loan by Beal Bank funded $13,000,000 at closing with the balance available to draw for tenant improvements and leasing commission. The Property enjoys a highly visible location along the Katy Freeway (I-10) in Houston’s sought-after Energy Corridor submarket. EC1 is strategically positioned approximately thirty (30) minutes from Downtown Houston, twenty-five (25) minutes from the Houston Galleria, and fifteen (15) minutes from Downtown Katy, providing excellent connectivity to key business districts and desirable suburbs. The surrounding area features myriad corporate headquarters, prestigious residential neighborhoods, including Memorial and Cinco Ranch, and is in close proximity to various amenities such as dining, entertainment, and recreation. A similiar CCI partnership purchased Energy Crossing II next door in November 2024 and is in lease up phase creating traffic for both partnerships.

CCI invites you to explore a value add investment opportunity in Houston's suburban office market, which has quietly outperformed urban areas. Right now, there is an opportunity to purchase office properties at an incredible discount, and here's why: ● Constructed in 2008, this 6-story, 240,166 SF property features a 3.87/1000 SF parking ratio with 888 garage spaces and 42 surface space (929 total spaces). ● Energy Crossing I offers efficient floor plans, making it ideal for a large corporate user or multiple tenants, thanks to its average floor plates of 40,000 SF. ● The building’s first-generation space is in excellent condition, enhanced by high-end finishes like polished granite floors, Venetian plaster, and floor-to-ceiling glass with sound-dampening glazing, positioning it as a premier suburban Houston office asset. ● The building contains multiple amenities of key importance to tenants in today’s market: a fitness center of exceptional quality in the adjacent building, offering free weight and machine workout equipment, within Energy Crossing II is accessible to tenants in Energy Crossing I. The facility is equipped with club-style locker rooms with controlled access for maximum security and after-hours access. ● On site delicatessen and café.

Energy Crossing I offers an abundance of parking, enhancing its appeal to tenants. The Property's location within the Energy Corridor, combined with its high-quality amenities and modern design, and its adjacency to Katy ISD the #1 ranked Houston public school district, aligns perfectly with the current trend of tenants seeking premium office spaces in sub-markets that allow access to top school districts. This makes Energy Crossing I a highly desirable choice for businesses looking for a top-tier office experience in Houston's dynamic market. This competitive price, significantly below the estimated replacement cost, provides substantial flexibility and basis-play pricing power in a prime office sub-market.

Class A LP shares have a 15% preferred return and an additional 15% pro-rata allocation of net profits. Projected returns for a 3 year hold are a 23.4% IRR and a 1.88x equity multiple. Projected returns for a 4 year hold are a 19.4% IRR and a 2.03x equity multiple.

- “Class A” office property built in January 2008 by Opus, currently 38.8% occupied. MD Anderson Imaging Center is located on the ground floor under a long term lease.

- Exceptionally low basis: Acquiring at just 30.6% of last sale price ($56.4M ($235/SF), June 2014)

- Submarket expertise: CCI owns three (3) other buildings in the immediate vicinity and has already signed over 100k SF of new leases at these properties since mid-2024

- Outperformance of high-quality office assets in the Energy Corridor: Average Weighted Occupancy: 85% (5-Star Weighted Average Occupancy: 90%1, 4- Star Weighted Average Occupancy: 82%)

- Prime frontage on the Katy Fwy (I-10), adjacent to 4-way exit. Avg. Vehicles Per Day (2022): 263,771

- The Right Time to Buy: Continued “flight-to-quality” trends; companies moving closer to their employees in suburbs west of Houston make the Energy Corridor one of the most attractive office submarkets in the US for real estate investors

- Below are Drone fly-through videos of floor 2, floor 3 and floor 4 at Energy Crossing I.

- Floor 2 https://youtu.be/yL1WwbWdxgI

- Floor 3 https://youtu.be/eXXbiiJBQYo

- Floor 4 https://youtu.be/vgMYEacei3s

- Asset Type

- Class A Office W/ Structured Parking · Office

- Year Built

- 2008

- Building Class

- A

- Building Size

- 240,164 SF

- Lot Size

- 5.35 AC